|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Process of Getting a Loan for a HouseIntroduction to Home LoansPurchasing a home is a significant financial commitment, and securing a loan for a house is often a crucial step in this journey. A home loan, also known as a mortgage, is a way for individuals to finance the purchase of a property by borrowing money from a lender. This article will guide you through the process, providing valuable insights to help you make informed decisions. Types of Home LoansFixed-Rate MortgagesFixed-rate mortgages offer a stable interest rate throughout the loan term, making it easier to budget your monthly payments. This type is ideal for those who plan to stay in their home for a long period. Adjustable-Rate MortgagesAdjustable-rate mortgages (ARMs) start with a lower initial interest rate, which adjusts periodically. ARMs can be beneficial if you expect to move or refinance before the rate changes. Steps to Secure a Home LoanAssess Your Financial Situation

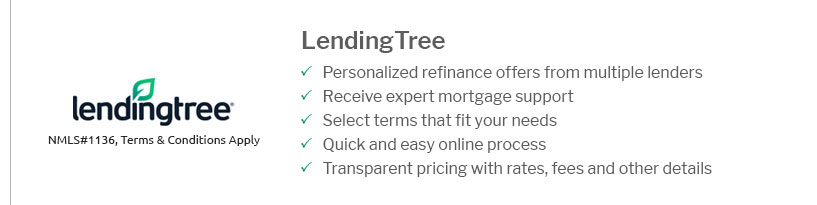

Research and Compare LendersIt's essential to compare offers from different lenders. Consider looking at mortgage rates rates today to get an idea of the current trends and options available. Get Pre-Approved

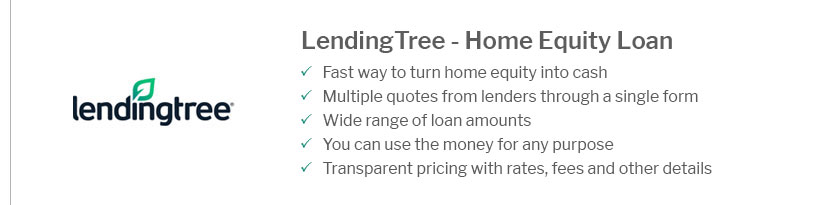

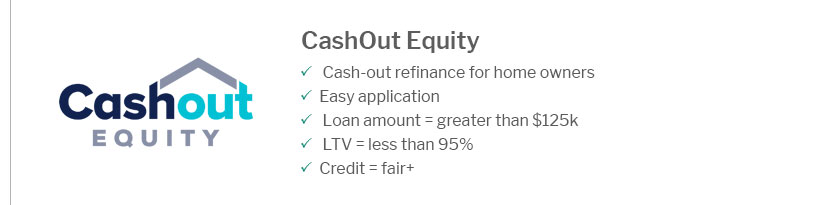

Factors Influencing Loan ApprovalSeveral factors can affect your ability to secure a loan for a house. These include your credit score, employment history, and the amount of your down payment. Additionally, lenders will evaluate the property's value to ensure it matches the loan amount. Refinancing OptionsIf you already have a mortgage, refinancing might be an option to consider. By exploring refinance home loan interest rates, you can potentially lower your monthly payments or shorten the term of your loan. FAQ SectionWhat is the minimum credit score required for a home loan?The minimum credit score required varies by lender, but a score of 620 is typically the baseline for conventional loans. FHA loans may require a lower score. How much should I save for a down payment?A 20% down payment is standard to avoid private mortgage insurance (PMI), but some programs allow for lower percentages, such as 3% to 5%. Can I get a loan if I am self-employed?Yes, self-employed individuals can qualify for home loans. You'll need to provide additional documentation, such as tax returns and financial statements, to verify your income. ConclusionSecuring a loan for a house involves careful planning and consideration. By understanding the types of loans available and the steps involved in the process, you can make informed choices that align with your financial goals and homeownership dreams. Remember to consult with financial advisors and lenders to find the best options tailored to your needs. https://www.consumerfinance.gov/owning-a-home/explore/understand-the-different-kinds-of-loans-available/

Not all home loans are the same. Knowing what kind of loan is most appropriate for your situation prepares you for talking to lenders and getting the best ... https://www.bankofamerica.com/mortgage/

Our home loans and low home loan rates are designed to meet your specific home financing needs. https://www.usbank.com/home-loans.html

Home mortgage loans are offered by lenders to qualifying borrowers. A borrower pays back the home loan over an agreed length of time called a term.

|

|---|